2Q 2025 Cost Report: With Tariffs Still Uncertain, Used Equipment Prices Show Signs Of Leveling Off, For Now

[ad_1]

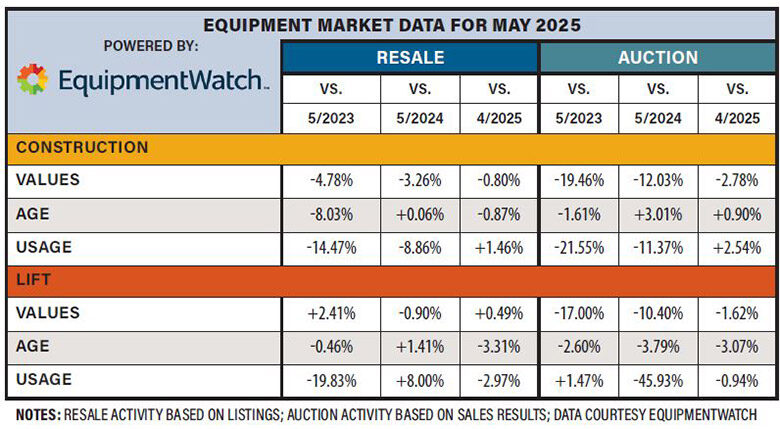

The first few months of this year saw some uncertainty in equipment pricing, but even with the unclear tariff situation the used equipment market has seen prices stabilizing, according to the latest data from industry analyst firm EquipmentWatch. Prices for used equipment at resale and auction are down year over year, but the month-to-month values have been fairly stable, says Brendan Gallagher, data analyst with EquipmentWatch.

“Everything is down, comparing the May numbers to April,” he says. “But there’s still a lot of volatility in all sales from fear of tariffs.”

While many were bracing for a massive disruption to the equipment market due to volatile U.S. tariff policies, the impacts have mostly been on the sales of new machines, with original equipment manufacturers trying to bake in some price increases if they have to pay tariffs for imported equipment or components. But used equipment is a different matter.

“[Recent declines] look like age depreciation since the tariff talk has cooled down,” says Gallagher. “At the start of the year we did see the value of some equipment shoot up, but now it looks like the market is settling.”

And values at midyear tend to increase slightly if anything, adds Gallagher. “We get the new listings for 2025 machines around then, and we see them being sold more as used rather than new.”

Data from EquipmentWatch also shows a precipitous 12% drop in auction values, which is unusual, says Sam Pierce, EquipmentWatch sales analyst. “We haven’t see a drop like that in a while. Construction equipment is usually fairly consistent.” There have also been steady year-over-year drops in usage on used machines, reflecting perhaps that the last of the Covid-era disruption has passed and firms are re-fleeting at normal rates.

But the outlook for OEMs is a bit more mixed. John Deere reported another decline in sales and profit for its construction and forestry division in the second quarter. CEO John May told investors on a May 15 earnings call that “this quarter was marked by historic levels of volatility and significant uncertainty across our end markets, given the dynamic global trade backdrop.” He reaffirmed the company’s commitment to its existing markets, but did acknowledge the “difficult macro environment we are facing.” Deere’s construction and forestry sales were down 23% year over year, from $3.8 billion to $2.9 billion. The company is forecasting demand in the Americas for construction machines to remain flat or slightly decline for the rest of 2025. The company has taken several initiatives to lessen the impact of tariffs, including a $20-billion investment in its U.S. manufacturing operations over the next ten years.

Caterpillar also saw a dip in its first quarter earnings report, issued April 30. Sales and revenue was $14.2 billion, down 10% year over year, and operating profit was down $2.6 billion, a 27% YOY drop. But Tony Fassino, Caterpillar group president for construction industries, said larger orders from dealers in 2024 are still being sold through. And while reshoring can alleviate some of the pressure of tariffs, “you don’t just say, boom, change source today. It’s not quite that quick.”

But despite some headwinds on pricing, Fassino was optimistic about the rest of 2025, and said dealing with the uncertainty comes down to “flexibility.”

[ad_2]

Source link

Post a Comment

You must be logged in to post a comment.