House Republicans Advance ‘One Big Beautiful Bill’ With Narrow Support

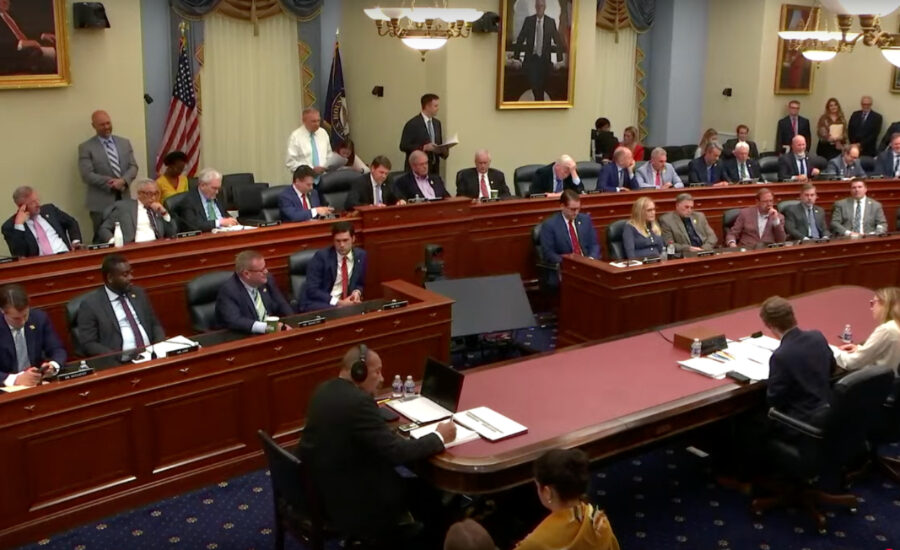

Lawmakers on the House Budget Committee voted to advance their spending and tax legislation known as the One Big Beautiful Bill Act by a narrow margin during a weekend hearing May 18. The 1,116-page package includes several key provisions impacting the construction industry.

Four Republicans—Reps. Ralph Norman (S.C.), Andre Clyde (Ga.) Chip Roy (Texas) and Josh Brecheen (Okla.)—voted against the bill and blocked it on Friday, but answered “present” at Sunday’s hearing, allowing the measure to advance by a 17-16 vote. Rep. Lloyd Smucker (R-Pa.) also voted against the bill on Friday, but voted in favor on Sunday.

The committee also voted along party lines to block four amendments proposed by Democrats.

Lawmakers are moving the legislation ahead of House Speaker Mike Johnson’s (R-La.) Memorial Day deadline. Appearing on Fox News Sunday ahead of the committee vote, Johnson said he hopes to move the bill before the Rules committee by mid-week and have it on the House floor by the end of the week to make his deadline. The House Committee on Rules scheduled a hearing on the bill at 1 a.m. May 21.

“We’re on track, working around the clock to deliver this nation-shaping legislation for the American people as soon as possible.” Johnson said. “All 11 of our committees have wrapped up their work, and they spent less and saved more than even we projected initially.”

But some Republican lawmakers, including the four who voted “present” May 18, want to move up the addition of Medicaid working requirements that would take effect in 2029 and to end renewable energy tax benefits. The House Freedom Caucus criticized portions of the bill, saying in a statement that it would increase near term deficits, and that promised savings are years away or may never materialize.

“The bill does not yet meet the moment,” Roy wrote in a post on social media.

Democrats have also criticized the legislation over cuts to health care and food benefits programs, in addition to the deficit.

“I am worried about this bill because this is an incredibly huge wealth transfer from working families to the very wealthiest Americans, the billionaire class,” Democratic Whip Katherine Clark (Mass.) said while appearing on MSNBC’s Ana Cabrera Reports.

Once through the House, the legislation will go to the Senate. There, Republicans will only need a simple majority, rather than three-fifths, to pass the bill due to the reconciliation process.

Spending and Tax Cuts

The package also includes cuts to programs benefiting the environment and clean energy projects that Congress previously established in 2022’s Inflation Reduction Act. It would also extend and make permanent tax cuts from 2017 that benefit many contractors but are otherwise due to expire.

Those cuts would impact the U.S. Environmental Protection Agency’s Greenhouse Gas Reduction Fund and the Dept. of Energy’s Loan Programs Office and Tribal Energy Loan Guarantee Program, among other programs. Some funding for transmission projects would also be cut.

The bill will eliminate hundreds of thousands of energy jobs and “includes other deeply troubling provisions,” said Sean McGarvey, president of North America’s Building Trades Unions (NABTU) in a statement. He added that NABTU is hoping lawmakers will address the group’s concerns before the bill reaches the House floor.

“One of our top priorities in this process has been protecting meaningful job opportunities, but that priority is being completely undermined,” McGarvey said. “Job cuts for blue-collar Americans should not foot the bill for billionaire tax cuts.”

The bill would create a “de-risking compensation program” within the Energy Dept. to protect some energy project owners from federal action that leads to “unrecoverable losses” on under-construction projects. Project owners would have to pay an enrollment fee equal to 5% of their expected capital costs plus 1.5% annual premiums to join and remain in the program, and in return would be able to file a request with the Energy secretary for compensation in the event of any federal action that revokes approval or otherwise delays a project or makes it no longer viable. The program would be open to developers of fossil fuel and nuclear projects, but not for solar or wind projects.

The package would extend many of the provisions from 2017’s Tax Cuts and Jobs Act, including a key one making 199A deductions for pass-through businesses permanent. The majority of construction firms qualify under the program. The deduction would also be increased from 20% to 23%.

It would also eliminate taxes on overtime pay for most workers through 2028.

Overall, the nonpartisan Committee for a Responsible Federal Budget estimates the package would add $3.3 trillion to the national debt over a decade and boost the 2027 deficit by $600 billion.

Post a Comment

You must be logged in to post a comment.